Have A Info About How To Write Hardship Letter For Loan Modification

How to write a hardship letter for mortgage loan modification | pdf | refinancing | loans.

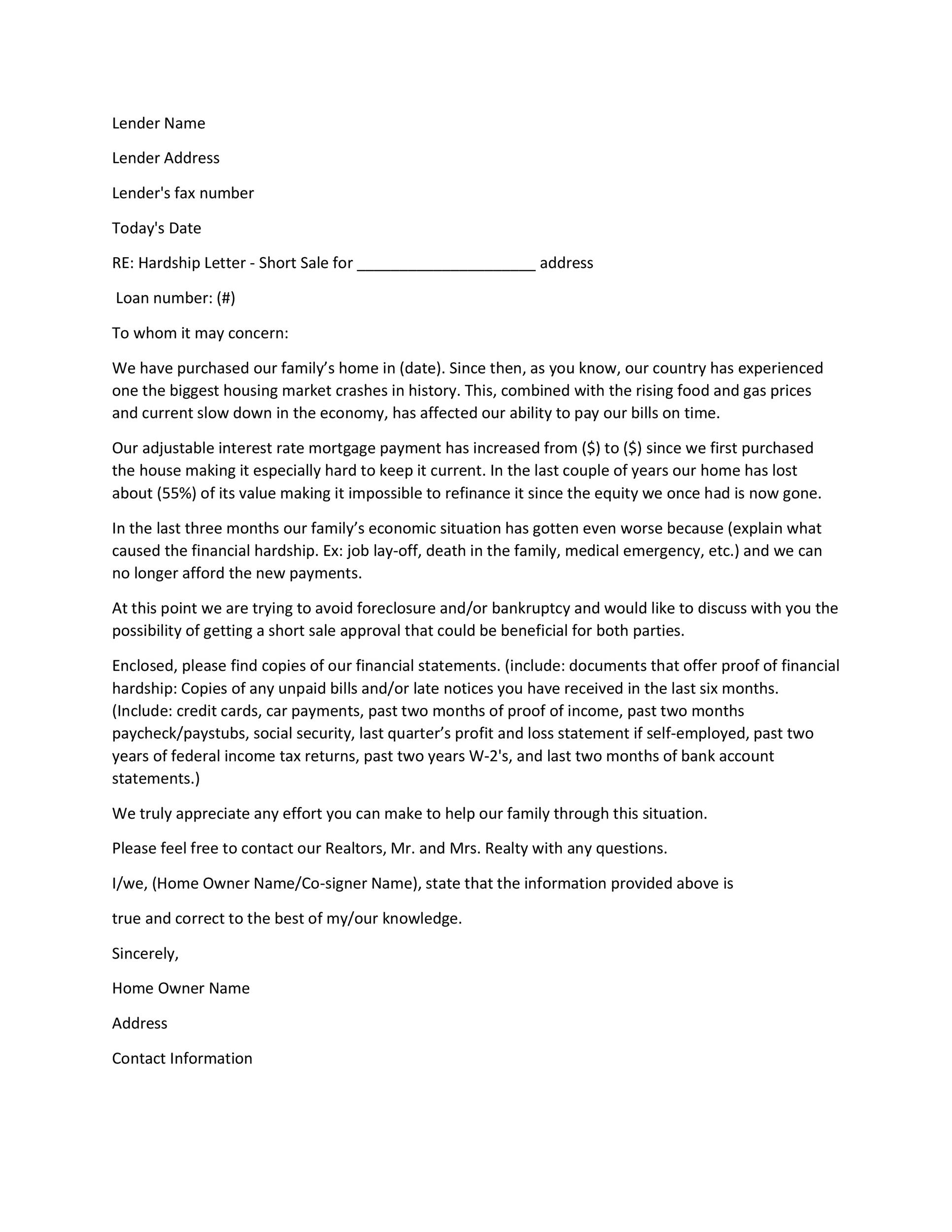

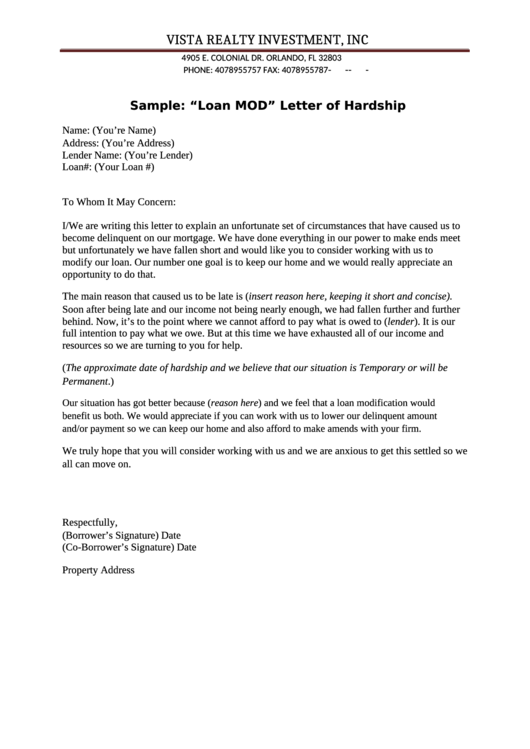

How to write hardship letter for loan modification. Homeowner name (s), address (s), and phone number (s). Some lenders, however, may require a loan modification letter. Four paragraphs is ideal, and no more than two pages.

Some key features of a hardship letter include the following: Keep your hardship letter brief and to the point: The main purpose of your hardship letter is to explain why you are unable to pay your.

It should help you clarify your specific financial situation and justify defaulting on your debt. You will most likely have to provide specific information about your financial hardship. Describe your financial hardship and the.

In a hardship letter for loan modification, you should include the following. Include your name, mortgage loan number, and property address. A hardship letter explains to a lender the circumstances that have made you unable to keep up with your debt payments.

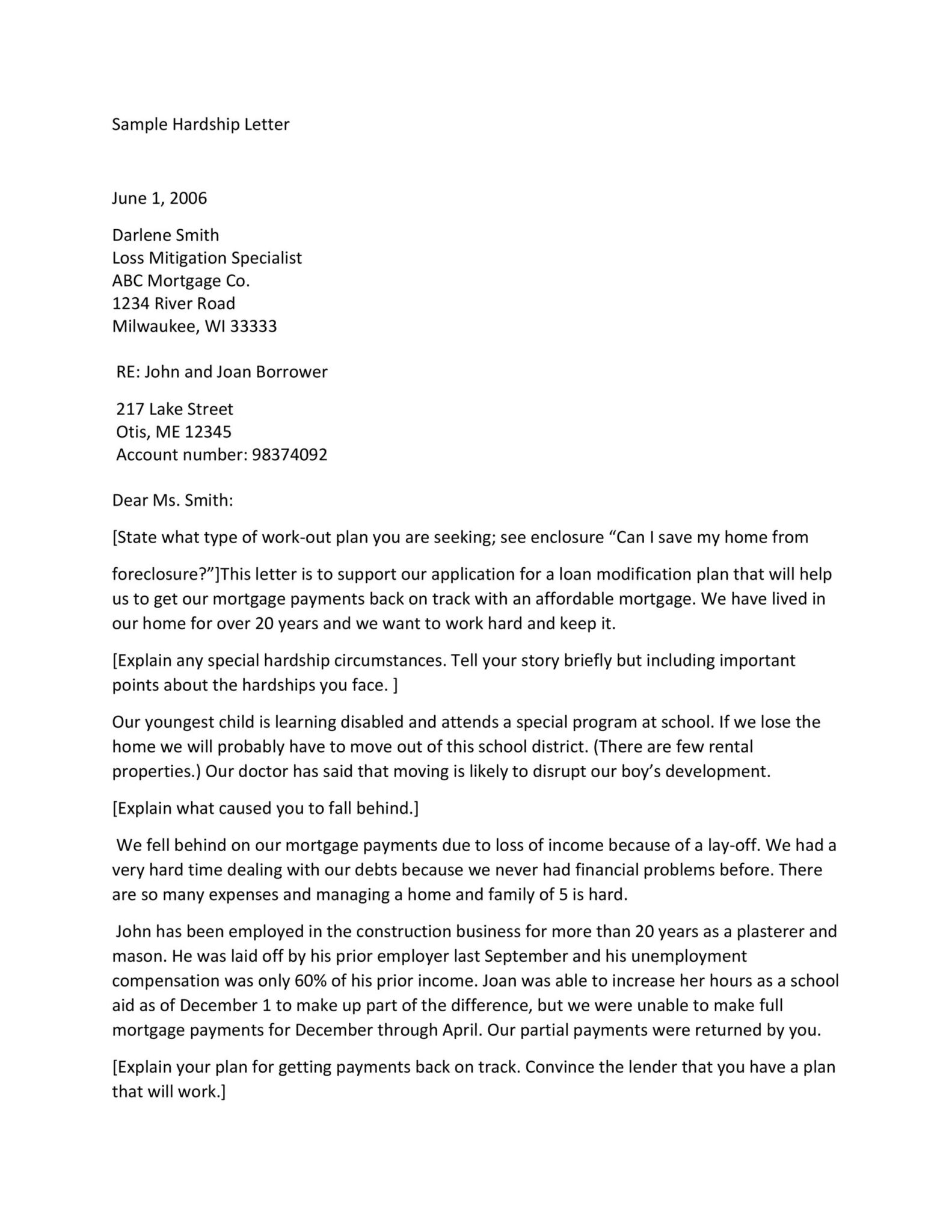

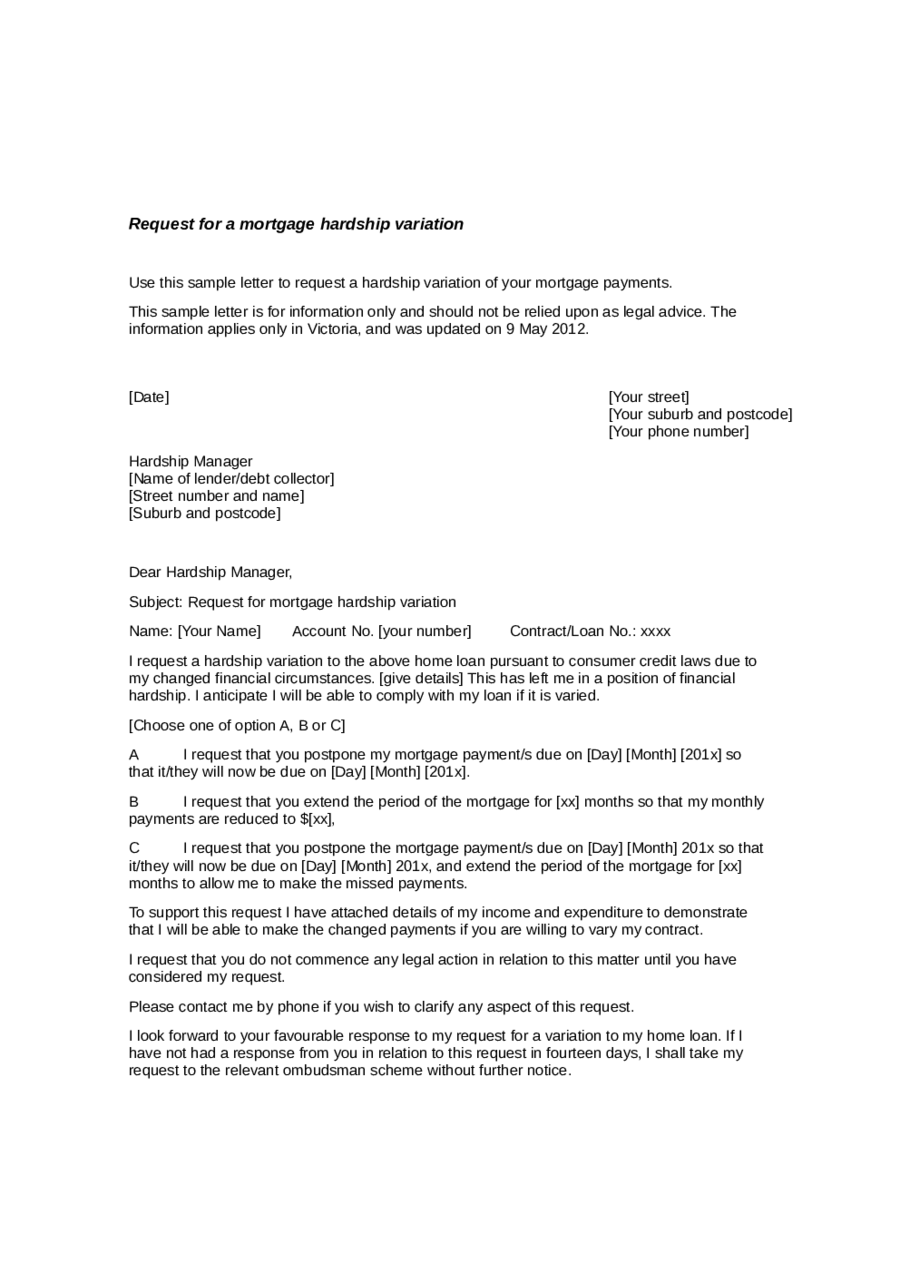

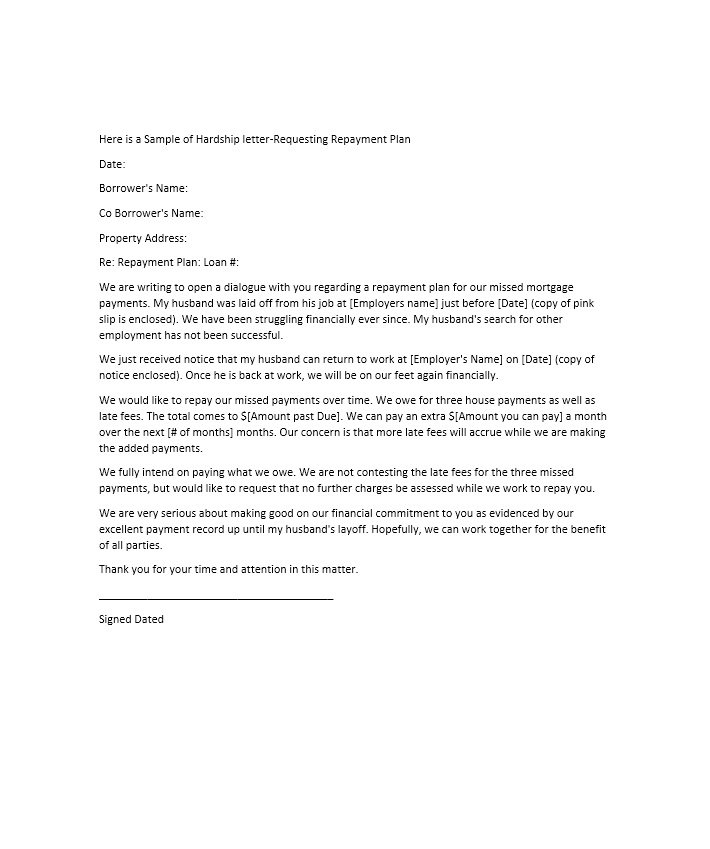

Learn how to write a loan modification hardship letter to request a change in the terms of repayment due to unforeseen financial hardship. A financial hardship letter is a written document for your lender explaining why you’re unable to meet your financial obligations. A mortgage financial hardship letter requests a lender for loss mitigation on a mortgage loan — such as a loan.

A loan modification application is only. See a sample letter format and tips for. At the top so your bank can locate your home loan easily.

Let’s learn more about how these. Word 2003 (.doc) openoffice (.odt) description. A hardship letter is a personal letter that you write to your lender explaining why you fell behind on your.

Use this template to help you write a letter of. In the first paragraph, state that you are requesting a loan modification. What should i include in a hardship letter for loan modification?

2.1k views 2 years ago miami. My company's revenue is because i currently make. A financial hardship letter may be necessary to persuade your lender to change the terms of your mortgage.

1 starting your letter. State your hardship and its cause. A hardship letter is a key factor in getting approved for a loan.

![Free Printable Hardship Letter Example [PDF, Word] Financial & Immigration](https://www.typecalendar.com/wp-content/uploads/2023/05/hardship-letter-for-loan-modification.jpg?gid=445)