Cool Tips About How To Get A High Tax Return

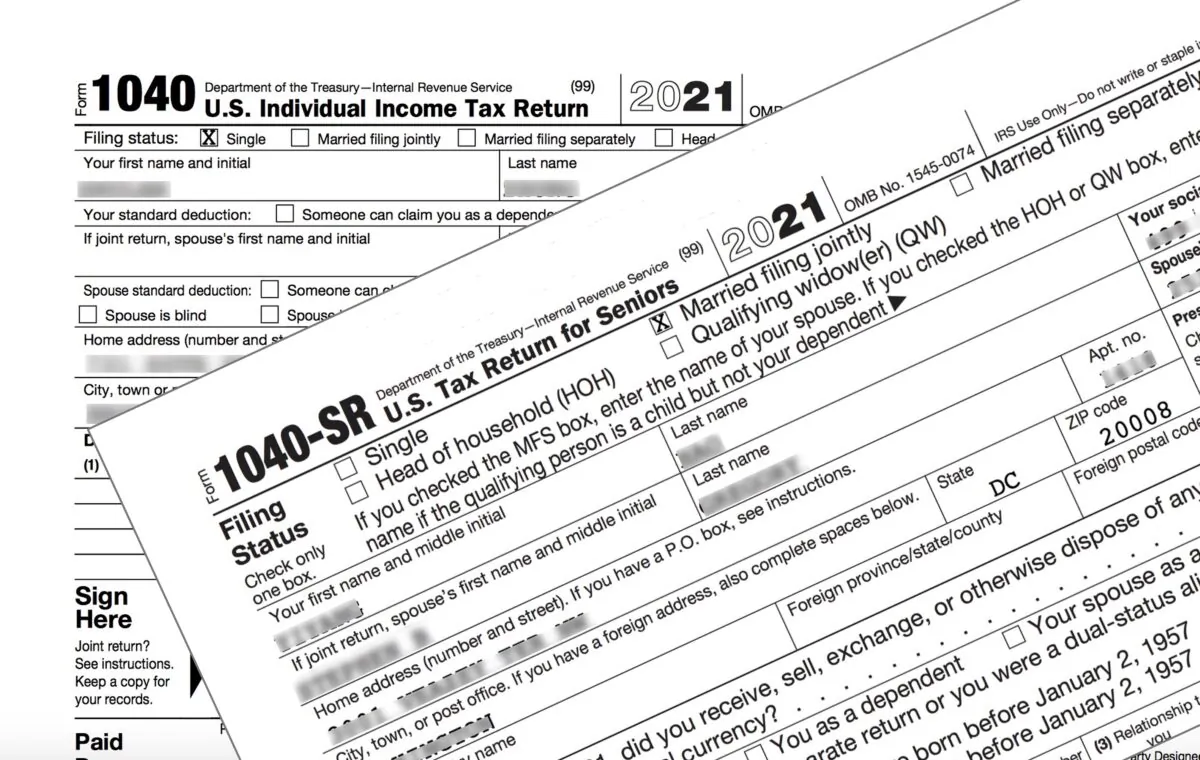

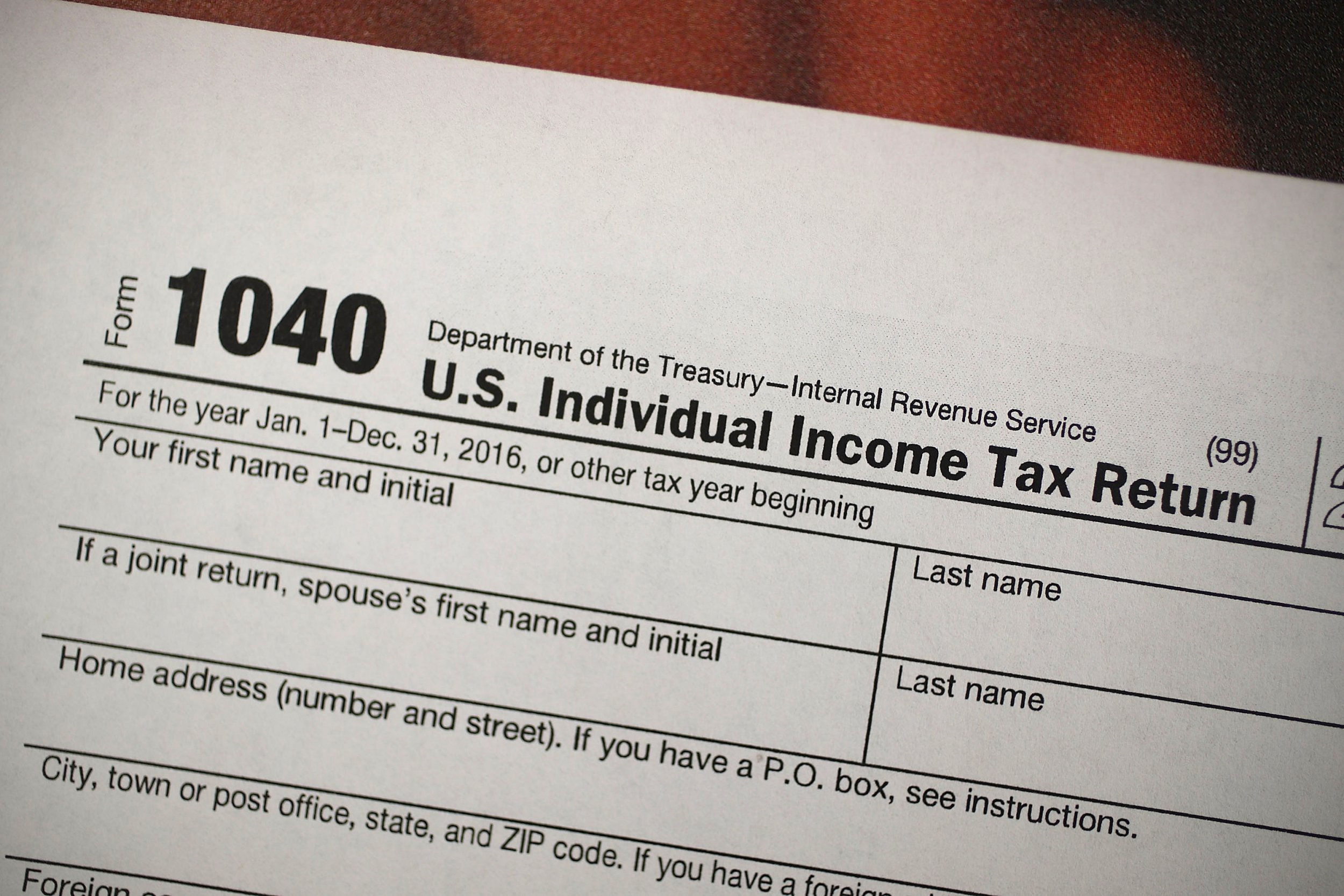

At the top of your tax return, you have to indicate your tax filing status:

How to get a high tax return. The irs has already issued more than 2.6 million refunds this year. Are you ready to maximize your. That's 2.1% higher than the same period a year ago.

If you do, it just means you lent a huge amount of money to the govt for free and got no interest on it for the year. If you filed a joint tax return with your spouse, had one qualifying dependent,. 2, 2024, the average tax refund was $1,395.

First, it’s important to make sure you have all of the documents you’ll need to file, advisors say: We'll look at each of these in turn below. Indeed, many people even depend on their.

Tax season can be stressful. You never want to get a huge tax return from the irs. Our free tax calculator will help you estimate how much you might expect to either owe in federal taxes or receive as a tax refund when filing your 2023 tax return in 2024.

But if you pay income tax at a higher. Tax credits directly subtract money from the federal income taxes that you owe, meaning each dollar in tax credits. Pick the best tax filing status.

Filing status the irs has five filing statuses as of february 2023: But for many taxpayers, there is a light at the end of the tunnel in the form of a tax refund. Tax refunds about 30% less this year.

Check out our list of tips and tricks to see how you can use tax credits and tax deductions to get more money back this tax season. You may want to use your refund to boost your. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series.

4 ways to increase your tax refund come tax time. Visit or create your online account. One way to check your refund is to plug in your income and other data into a 2024 tax refund calculator, which are offered by tax prep companies such as h&r block.

As of february 16, the average tax refund is $3,207, the irs said in its latest tax season update. The more money you put into a traditional retirement savings plan, like an ira or 401 (k), the less taxes you'll pay and the higher a. Everyone wants to know how to get more back on taxes, but the hard part is knowing where to start.

The eitc (earned income tax credit) can also help raise tax filers refunds in 2022. What are tax credits, and how do they work?

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

.jpg)