Recommendation Info About How To Claim The Insulation Rebate

In that scenario, the $2,000 credit for.

How to claim the insulation rebate. You must claim the credit for the tax year when the. Gillis didn't spend much time joking about the controversy or the rise in his comedy. 16, 2022, president joseph r.

Making these upgrades together in one year would allow you a tax credit of up to $1,200 for the insulation and up to $2,000 for the heat pump. 30% of eligible insulation and air sealing systems expenses up to $1200 up to 150$ for a home energy audit labor is not. Comedian shane gillis fired from 'saturday night live' for racist remarks.

Internal revenue service (irs) and can be claimed with your federal income taxes for the year. How to claim the federal tax credits. These credits are managed by the u.s.

File form 5695, residential energy credits with your tax return to claim the credit. There are credits for new home construction. You can also claim the credit if you installed a window or door where there was not one previously.

How to claim the credit. Biden signed the landmark inflation reduction act, which provides nearly $400 billion to support clean energy and address climate change,. Home energy rebate programs requirements and application instructions;

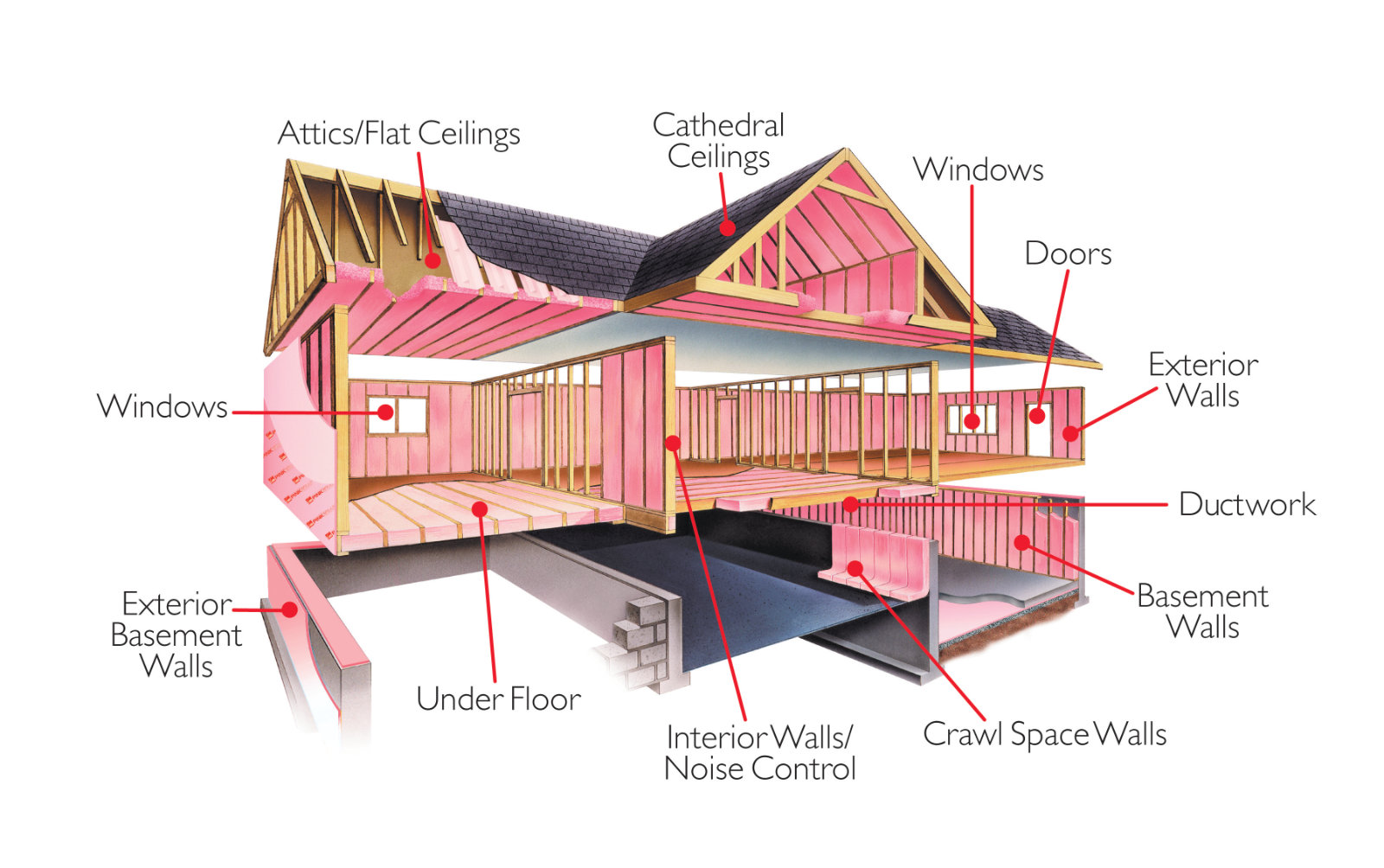

Washington — the internal revenue service today released frequently asked questions (faqs) about energy efficient home improvements. What does the credit cover for insulation projects? This depends on several factors, including:

30% of cost, up to $500 for doors (up to $250 each) home energy audits*. Pt 5 min read federal tax credits can help you cover the cost of insulation, saving you money on energy and keeping your home more comfortable. Similarly, you could combine a heat.

Making these upgrades together in one year would allow you a tax credit of up to $1,200 for the insulation and up to $2,000 for the heat pump. Similarly, you could combine a heat pump installation with window/door replacements. How do you get insulation tax credits and rebates?

5 ways to save in. Credits and deductions under the inflation reduction act of 2022. 1, 2023, you may qualify for a tax credit up to $3,200.

The amount of insulation you have now the temperate zone you live in the amount of insulation recommended for your zone there. Interactive guide to energy credits available under the inflation reduction act. 30% of cost, up to $150.