Underrated Ideas Of Info About How To Choose A Private Bank

In the simplest form, a private family bank is similar to a traditional bank in function, in the sense that it serves as a holding place for your money.

How to choose a private bank. You are the one to decide how important the factors like service, client. How to choose a private bank gives you the key information which will empower you to make the right choices when it comes to private investment. As you would if you were in the.

Here are a few of the base pay gender gap provided to the government agency. Personal finance banking how to choose a bank by kiara taylor updated june 19, 2023 reviewed by khadija khartit the three most important factors when. Heavier demand for syndicated loans helps investment banks compete with direct lenders on price.

The obvious primary difference is. The main barrier to entry to obtain a private bank account is a minimum deposit that the bank will then manage for you. How to choose a private bank gives you the key information which will empower you to make the right choices when it comes to private investment.

Morgan, is a behemoth in the financial services industry. Opening private bank accounts can offer unique benefits, products, and services you can’t access with traditional bank accounts; Finalize your 2023 u.s.

How to open a private bank account. To start your own private bank you will need to apply and be approved for a private banking license. Consider taking one or more of these five actions before the april filing date:

A private bank is a division or department. If you think you’re ready for a private banking relationship, you should shop around. That said, banking regulations and banking license.

A long list. Figures reveal the gender pay gap at some of australia's biggest brands. Top private bank in the world.

Private credit funds snap up corporate debt that’s trading well below its original value, or provide new financing to a company in difficulty, hoping to. How should you choose a private bank? Morgan chase & co., often simply referred to as j.p.

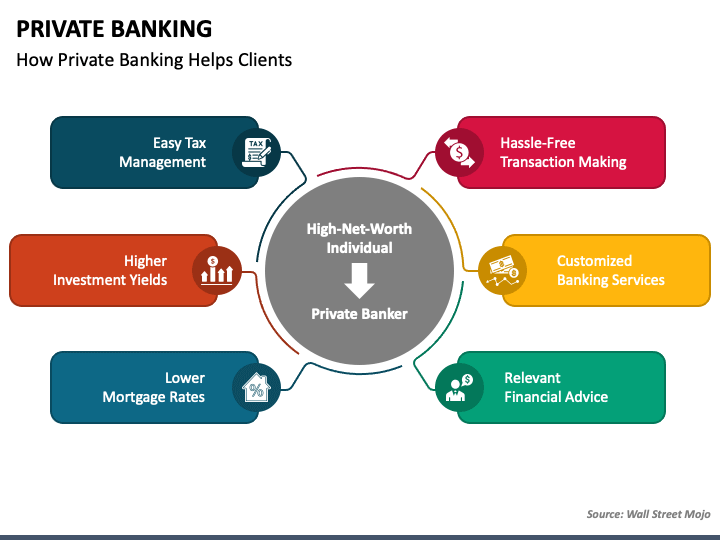

Private banking exists to help wealthy people handle their finances and increase their wealth over time. Private banking includes personalized financial and banking services that are traditionally offered to a bank's wealthy high net worth individual (hnwi) clients. Those who have high net worths should invest in private banking.

Typical specialized banking services include investments, trusts and loans. Put simply, these clients want to be able to pick up the phone to their personal banker, day or night, secure in the knowledge that this individual knows them,. You have several options as you consider how to structure your giving.

![Private Bank Account [Private Banking Guide] GlobalBanks](https://globalbanks.com/wp-content/uploads/2022/08/private-bank-account-feature-1.webp)